Valuation, Ownership Structure and

Investor Relations Outreach

After two economically complicated and challenging years (2008 – 2009), during 2010 we witnessed good signals of economic recovery in the majority of the world’s regions, particularly in the emerging markets. These included both Mexico and Brazil, where Homex today has operations. Nonetheless, continued economic pressures impacted the capital markets in 2010, including: uncertainties surrounding sovereign concerns in Europe; signs of a renewed recession increasing through April in the U.S; and, in emerging markets, tightening policies to curb foreign fund inflows and currency appreciation, as well as uncertainty around monetary withdrawals. As a result, stock exchange performance around the globe was a day-to-day proposition, strongly impacted by a volatile news environment.

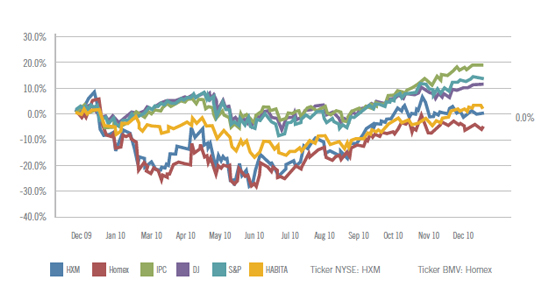

During the first half of 2010, share prices and indicative indices, such as Dow Jones, S&P 500 and IPC for Mexico, showed a negative performance, and it was not until the third quarter of the year that the markets turned, responding to some positive news, while deflecting precedent negative news about concerns of a lagging U.S. economic recovery, a euro crisis, etc. Ultimately, after a slow start and a tough second quarter, most markets in the world ended the year on a positive note.

The Dow Jones Industrial Average closed at 11,577.51 with a gain of 11.0 percent, outpaced slightly by the U.S. S&P 500 Index, with an annual increase of 13.2 percent to 659.13. On the Mexican stock exchange, positive economic indicators for the country supported an upturn in the yearly performance of the IPC index, which closed the year at 38,550.79 reflecting a gain of 20.0 percent.

The Mexican homebuilding industry index, the Habita index, closed the year with an annual performance gain of 3.5 percent lagging the performance of the major indices, mainly driven by investors’ initial negative reaction to the application of the INIF 14 accounting rule which became effective on January 1st 2010. Here, Mexican homebuilding companies revenue recognition changed from the percentage of completion accounting method to the date home title transfers to the homebuyer, and this change initially resulted in revenues declining from 15 to 18 percent. At the same time, homebuilding companies’ stock performance followed the market’s overall negative sentiment during the first half of the year, and it was not until the last months of the year when the cautious stance towards the homebuilding industry in Mexico started to reverse, thus erasing most of the valuation disparity seen during the first half of the year.

Reflecting investors’ concerns and cautiousness, Homex share price for the year closed off some 4.8 percent at Ps.70.00, while Homex’ ADRs closed the year at US$ 33.81, a 0.6 percent gain. Despite the negative and neutral performance of Homex stock and ADR prices, during 2010 the company grew its revenues by 12.4 percent over 2009.

The value-based trading volumes of Homex common shares and ADRs were stable year-on-year at Ps. 11,354.6 million in 2010 compared to Ps.11,350.4 million in 2009 and US$4,724.7 million in 2010 compared to US$4,715.3 million in 2009, respectively.